Aliko Dangote Stocks - A Closer Look

When folks talk about putting money into big businesses in Africa, the name Aliko Dangote often comes up. He's a very well-known figure, and his companies, which are a big part of the economy, have shares that people can buy. So, it's almost natural for many to wonder about these particular shares and what they might mean for someone looking to place funds.

People often hear about big companies and their shares, and sometimes they want to know more about how these things work. Aliko Dangote's businesses, you know, are quite large, and they touch many parts of daily life for a lot of people. This makes his company's shares something that a good number of individuals might find themselves thinking about, like your neighbor perhaps.

This discussion aims to shed some light on the shares linked to Aliko Dangote's businesses. We will look at who he is, what his main business group does, and some general points about how these shares work in the market. Basically, we want to give a simple overview, so you can get a better idea.

Table of Contents

- Aliko Dangote - A Look at His Beginnings

- What is the Dangote Group, actually?

- How Do People Get Involved with Aliko Dangote Stocks?

- Is there a way to understand Aliko Dangote Stocks better?

- What Does the Past Tell Us About Aliko Dangote Stocks?

- Factors Affecting Aliko Dangote Stocks

- What Might the Future Hold for Aliko Dangote Stocks?

- Thinking About the Long Term with Aliko Dangote Stocks

- Are there things to consider with Aliko Dangote Stocks?

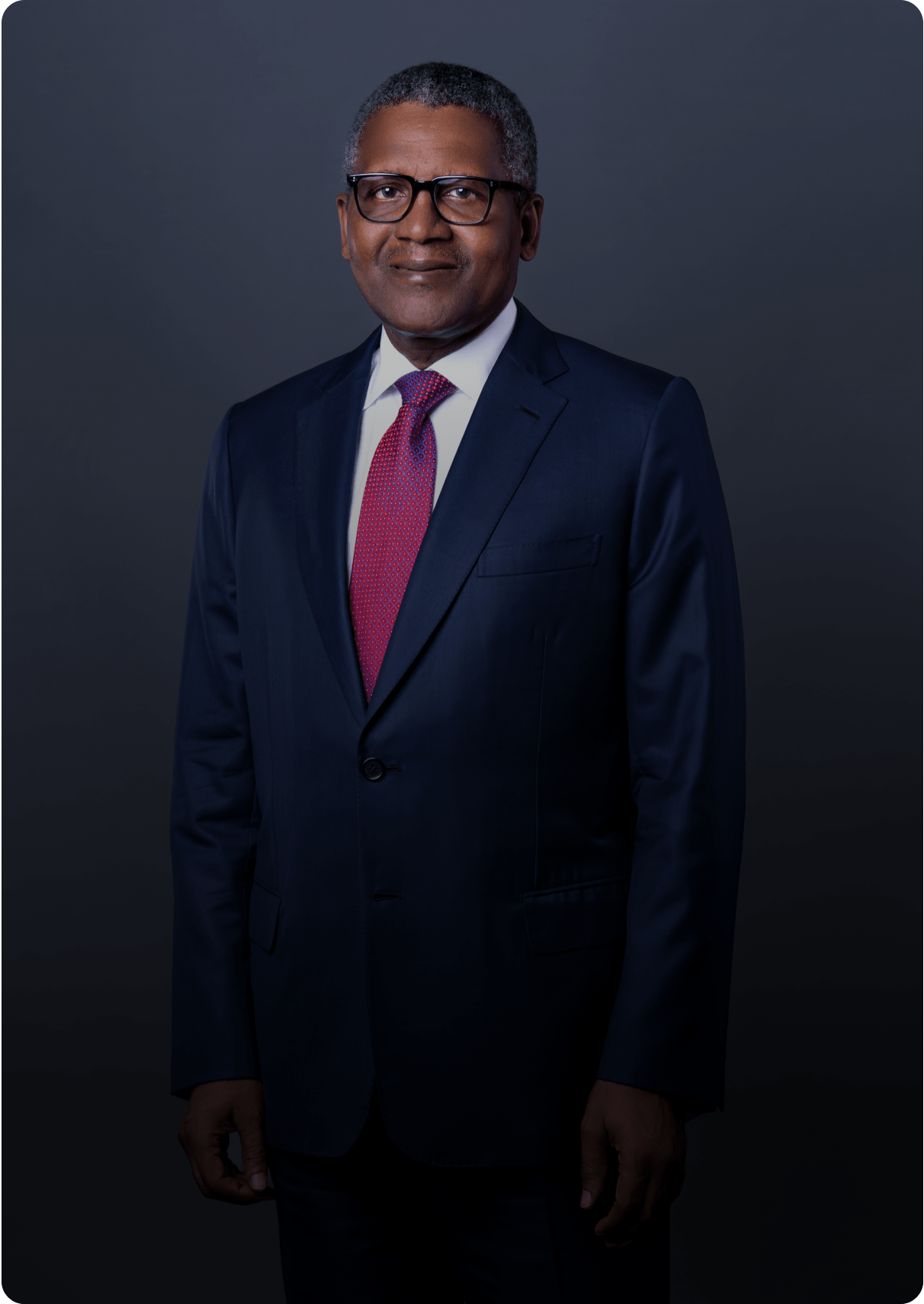

Aliko Dangote - A Look at His Beginnings

Aliko Dangote is a person whose name is known far and wide, especially when you talk about business in Africa. He was born in Nigeria, and from a rather young age, he showed a knack for commerce. His early life saw him getting a loan from his uncle to start a small trading operation, which is pretty interesting, you know. This was way back in 1977, and he began by selling things like cement and sugar. He had a clear idea of what he wanted to do, and that was to build something big.

He really worked hard to make his small trading business grow. Over time, he moved from just buying and selling goods to making them himself. This was a pretty big step, as a matter of fact. He saw that there was a need for local production, and he decided to fill that need. This change from trader to maker of goods was a key part of his story, and it really helped set the stage for the large group of companies we see today.

His story is often told as an example of someone who started small and built something quite large through a lot of effort and a clear vision. He is, you know, a figure that many look up to in the business world. He has certainly left his mark on the economic life of his country and the broader continent. We can see how his beginnings, simple as they were, led to something very substantial, which is quite inspiring for many.

Personal Details / Bio Data

| Full Name | Aliko Dangote |

| Date of Birth | April 10, 1957 |

| Place of Birth | Kano, Nigeria |

| Nationality | Nigerian |

| Known For | Founder and Chairman of Dangote Group |

What is the Dangote Group, actually?

The Dangote Group is a collection of businesses that Aliko Dangote put together. It's one of the biggest groups of its kind in Africa, so it's quite a large operation. The group has its hands in many different types of industries, which means it makes a lot of various products that people use every day. This range of activities is part of what makes it so important in the economic picture of the region, actually.

One of the main things the Dangote Group does is make cement. This is a very important material for building homes, roads, and other structures. So, they play a big part in making sure there's enough cement for all sorts of building projects. They have large factories that produce a lot of cement, and this cement gets used in many places. It's a pretty essential part of their business, you know.

Beyond cement, the group also deals with food items. They make things like sugar, flour, and salt. These are all products that people buy and use in their kitchens every day. They also have interests in things like packaging and even oil refining, which is a newer area for them. This wide spread of businesses means the group is involved in a lot of different parts of the economy, pretty much touching many aspects of life.

They also have operations that go beyond Nigeria, reaching into other countries in Africa. This shows how much the group has grown and how far its reach extends. It's not just a local business anymore; it has a presence across a wider area. This expansion helps them serve more people and, in a way, spread their influence across the continent.

How Do People Get Involved with Aliko Dangote Stocks?

When people talk about getting involved with Aliko Dangote stocks, they usually mean buying shares in one of the companies that are part of the Dangote Group. These companies, like Dangote Cement Plc, are listed on the stock exchange in Nigeria. So, to get these shares, you would typically go through a stockbroker, which is a person or a firm that helps you buy and sell shares. It's a bit like buying anything else, but instead of a shop, you use a broker, you know.

The first step for someone interested would be to open an account with a brokerage firm. This firm will then help you place an order to buy shares. You tell them how many shares you want and at what price, and they do the work of finding someone to sell those shares to you. It's a pretty standard process for buying shares in any company that is publicly traded. This is how many people gain a small piece of ownership in a big business, in a way.

It's important to know that when you buy shares, you are buying a tiny part of the company. This means that if the company does well, the value of your shares might go up. If the company faces difficulties, the value could go down. So, it's not a guarantee of anything, but it does mean you have a stake in how the business performs. This is, you know, the basic idea behind buying shares.

The shares are traded on the Nigerian Exchange, which is where people buy and sell these pieces of companies. The price of these shares can change throughout the day, depending on how many people want to buy them versus how many people want to sell them. This constant movement is what makes the stock market what it is, actually. It's a place where prices move up and down based on many factors.

Is there a way to understand Aliko Dangote Stocks better?

To get a better grip on Aliko Dangote stocks, it helps to do some looking into the companies themselves. You can read their financial reports, which tell you how much money they are making and what their costs are. These reports are usually put out every three months or once a year, and they give a lot of facts about the company's health. It's kind of like checking a business's report card, you know.

You can also look at news articles and market updates that talk about the Dangote Group. These pieces of information might tell you about new projects the company is starting, or any challenges it might be facing. Keeping up with the news can give you a clearer picture of what's happening with the business and, by extension, with Aliko Dangote stocks. It's pretty much like staying informed about anything else important.

Another thing to consider is what experts in the field are saying. Some financial analysts spend their time studying companies like those in the Dangote Group. They often share their thoughts on whether they think a company's shares will go up or down. While their opinions are just that, opinions, they can sometimes offer a different way of looking at things. So, it might be worth seeing what they have to say, sometimes.

Looking at the broader economy of Nigeria and Africa is also helpful. The performance of a country's economy can have a big effect on how well companies within that country do. If the economy is growing, businesses often do better, and this can affect the value of their shares. So, knowing about the general economic situation is, you know, a part of understanding these shares.

What Does the Past Tell Us About Aliko Dangote Stocks?

Looking back at how Aliko Dangote stocks have performed over time can give people some ideas, but it does not tell you what will happen in the future. Historically, companies like Dangote Cement Plc have seen their share prices go up and down, just like most shares on a stock market. There have been times when the prices moved upwards, and other times when they moved downwards, so it’s pretty normal.

For instance, during periods when the economy in Nigeria was doing well, and there was a lot of building going on, the demand for cement was high. This often meant that the company making cement did well, and its shares might have seen their value increase. This is, you know, a typical pattern for businesses tied to basic needs like building materials.

On the other hand, there have been times when economic conditions were not as good, or when there were other issues that affected businesses. During these periods, the value of the shares might have gone down. This shows that the shares are not always going to go up; they can also go the other way. It's just how markets tend to be, sometimes.

It's important to remember that past results are not a crystal ball for what's coming. A company's shares might have done well for many years, but that does not mean they will keep doing well in the same way. Many things can change that affect a company's performance and its share price. So, while looking at the past is a good starting point, it's not the whole story, as a matter of fact.

Factors Affecting Aliko Dangote Stocks

Many things can make the value of Aliko Dangote stocks change. One big factor is the general state of the economy. If the economy is strong, people and businesses have more money to spend, and this can lead to more building projects or more demand for everyday goods like sugar and flour. When demand for a company's products is high, the company often does better, and this can affect its share value. This is a very direct link, you know.

Government policies also play a role. For example, if the government decides to build a lot of new roads or houses, that means more demand for cement. Or, if there are changes in rules about importing goods, that can affect local producers like Dangote. These kinds of decisions from the government can have a pretty big impact on how businesses operate and how well they do. So, keeping an eye on what the government is doing is, in a way, quite important.

The price of raw materials is another thing that matters for Aliko Dangote stocks. Companies like Dangote Cement need things like limestone and coal to make their products. If the cost of these materials goes up, it can make it more expensive for the company to produce its goods, which can affect its profits. This, in turn, can sometimes make people less interested in buying the company's shares, which might affect their price.

What other companies in the same line of business are doing also has an effect. If there's a lot of competition, it can make it harder for a company to sell its products or to keep its prices high. This can affect how much money the company makes. So, looking at the wider business environment and what rivals are up to is, you know, a part of understanding the shares.

Lastly, any news specific to the Dangote Group itself can cause the shares to move. If the company announces a new, big project, or if there's news about its earnings, that can get people interested or worried, and this can make the share price go up or down. These company-specific events are, in fact, often very important for the short-term movement of Aliko Dangote stocks.

What Might the Future Hold for Aliko Dangote Stocks?

Thinking about what the future might hold for Aliko Dangote stocks involves looking at several things that could happen. The Dangote Group is still working on new projects and expanding into different areas, which could mean more chances for the businesses to grow. For example, their oil refinery project is a very big undertaking, and if it does well, it could open up new avenues for the group. This kind of expansion is, you know, a sign of potential for what is to come.

The overall growth of the African continent is also a point to consider. Many parts of Africa are seeing their populations grow and their economies develop. This means there might be more demand for basic goods like cement, sugar, and other products that the Dangote Group makes. If more people need these things, and if more building is happening, the companies could see continued demand for their products. This suggests a potentially positive outlook for Aliko Dangote stocks, generally.

However, there are also challenges that could affect the future. Things like changes in government rules, or unexpected events in the world, can always have an impact. For instance, if there are big shifts in how global trade works, or if there are new types of competition, these could present difficulties for the group. So, while there is potential for growth, there are also things that could make things harder, as a matter of fact.

The group's ability to keep its costs down and to operate efficiently will also be key. If they can make their products without spending too much money, that helps their profits. And if they can manage their businesses well, they are more likely to succeed even when things get tough. This internal management is, you know, just as important as the external conditions when thinking about the future of Aliko Dangote stocks.

Thinking About the Long Term with Aliko Dangote Stocks

When people think about putting money into Aliko Dangote stocks for a long time, they are usually looking beyond the day-to-day ups and downs of the market. They are considering the bigger picture of the company's place in the economy and its ability to keep making money over many years. This long-term view is, you know, a different way of looking at shares compared to just trying to make a quick gain.

For long-term thinking, it is often about whether the company provides things that people will always need. Cement for building, sugar for food, and fuel for energy are all pretty basic needs. If a company makes these kinds of essential items, it often has a more stable foundation, which can be appealing for someone thinking about holding shares for a long time. This is, in a way, a core idea for long-term placement of funds.

The leadership of the company also matters for the long haul. Aliko Dangote himself has been at the helm for a very long time, and his vision has shaped the group. How the company plans for its future leadership and how it continues to innovate will be important for its success over many years. This kind of forward planning is, you know, a very important part of a company's lasting strength.

Also, how the company manages its money and its debts is a big part of its long-term health. A company that has a good handle on its finances is more likely to weather difficult times and continue to grow. So, looking at the company's financial reports over several years can give a better sense of its stability for those considering a long-term interest in Aliko Dangote stocks.

Are there things to consider with Aliko Dangote Stocks?

Yes, there are definitely things to keep in mind when thinking about Aliko Dangote stocks, just like with any shares. One important point is that the value of shares can go down as well as up. There is always a chance that you could get back less money than you put in. This is a basic rule of the stock market, and it is something that people should always remember, you know.

It is also generally a good idea not to put all your funds into just one type of share or one company. Spreading your funds across different companies and different kinds of businesses can help manage the chances of loss. This is often called spreading out your funds, and it is a common way to approach putting money into the market. It's a pretty sensible approach, basically.

The market for shares in Nigeria can also be affected by local events, like political changes or shifts in the economy. These things can sometimes cause the prices of shares to move quite a bit. So, being aware of the local situation is, you know, a part of understanding the possible ups and downs of Aliko Dangote stocks.

Getting advice from someone who knows a lot about shares and markets is often a good step. A financial advisor can help you understand your own situation and whether placing funds in shares, including Aliko Dangote stocks, fits with your overall plans. They can help you think through all the different things that matter before you make any decisions, which is a very helpful thing to do, actually.

This article has covered several points related to Aliko Dangote stocks, including a look at Aliko Dangote's beginnings, what the Dangote Group does, how people might get involved with these shares, ways to understand them better, what past performance might suggest, factors that affect their value, and thoughts on their future and long-term view, along with important things to consider.

Aliko Dangote | Biography, Businessman, Group, Foundation, & Facts

Aliko Dangote - Welcome to Dangote Cement Plc

Aliko Dangote GCON – Omnia Strategy LLP